modified business tax id nevada

The TID is also known as the following. Safeguards Nevadas unclaimed property.

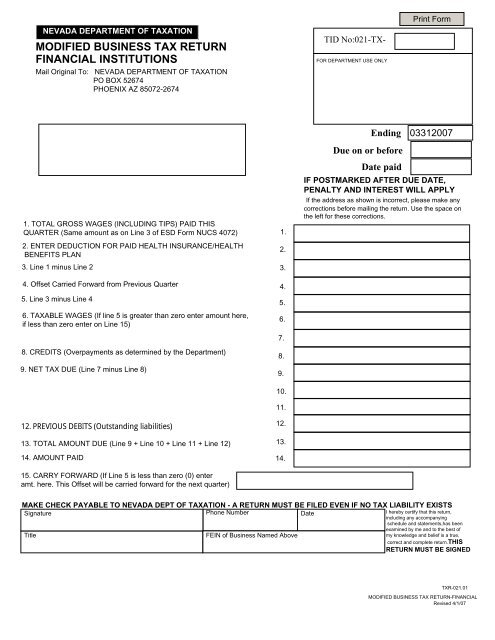

Modified Business Tax Return Financial Institutions

Guinn Millennium Scholarship Nevada Prepaid Tuition Program and the states 529 College Savings Plans programs.

. Compare 2022 state income tax rates and brackets with a tax data report. File Form 7004 Application for Automatic Extension of Time To File Certain Business Income Tax Information and Other Returns to request an extension of time to file. Refer to CBT-100 instruction 4 on where to file.

Although an EIN is most often used to identify a company such as an LLC with the IRS its also needed to open a business bank account apply for business licenses and permits do business with other companies and handle payroll for employees if applicable. Installment Payment for PC Fee 50 of Line 4 6. And dependency exemption is 217050 to 241850.

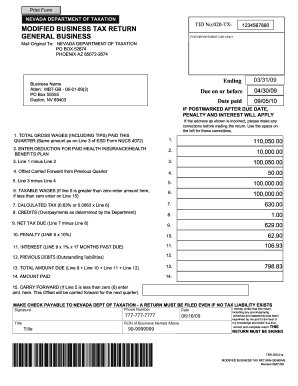

Total Tax and Fee Due Add Lines 1 to 5 7. Modified State Business Tax. Include the Federal ID and tax year.

Tax Forms General Purpose Forms Sales Use Tax Forms Modified Business Tax Forms Live Entertainment Tax Forms Excise Tax Forms Commerce Tax Forms Gold and Silver Excise Tax. All businesses must pay an annual tax on business equipment and furniture excluding inventories based upon the assessed value of. Less Payments made to date 8.

An EIN is a series of 9 numbers formatted like xx-xxxxxxx. Generally file Form 7004 by the regular due date of the REITs income tax return. REPORT TAX EVASION AND NON-COMPLIANCE.

The EIN numbers are sometimes referred to as a Tax ID number. The Tax ID or Taxpayer ID is located at the top right hand corner of the Welcome to Nevada Commerce Tax Letter. The facility located east of Reno is owned and operated by Tesla Inc and supplies the battery packs for the companys electric vehicles except vehicles produced at Giga Shanghai.

A Registered Retail Merchant Certificate b Tax Exempt Identification Number c Sales Tax Identification Number d Withholding Tax Identification Number The Registered Retail Merchant Certificate issued by the Indiana Department of Revenue shows the TID 10 digits and the LOC 3 digits at the top right. The State Treasurers Office administers the Gov. Nevada Day Sales Tax Exemption 0032pdf.

SalesUse Tax Permit Modified Business Tax Department of Taxation Local Business License. Used for asset protection in which the trust terms cannot be modified amended or terminated without the permission of the beneficiaryies. See the Instructions for Form 7004 for more information.

Or the sales tax. This address will be used to mail any licenses reports tax returns and correspondence. Failure to collect or remit Sales Tax.

Arkansas LLCs must file Annual Franchise Tax Reports. Operating without a Sales Tax Permit. New Hampshire however taxes interest and dividends according to the Tax Foundation.

And ensures the states investments and debt obligations are managed prudently and in the best interest of the people of Nevada. For taxpayers with modified Federal AGI exceeding 241850 no standard deduction personal exemption or dependency exemption is available. NV State Department of Taxation - Las Vegas.

If fully built out the building will have the largest footprint in the. Alterations of cash receipt journals. Business is the activity of making ones living or making money by producing or buying and selling products such as goods and services.

Tesla Giga Nevada or Gigafactory 1 is a lithium-ion battery and electric vehicle component factory in Storey County Nevada. Nevada Legal Forms Services is a registered legal document preparation service company that is dedicated to the philosophy that the law should be available to everyone at affordable prices. The NVBID or NV business ID is located on the NV business license of the business and can be looked up here.

The State of Nevada through GOED offers a variety of incentives to help qualifying companies make the decision to do business in the state including sales tax abatements on capital equipment purchases sales and use tax deferral on capital equipment purchases abatements on personal and modified business taxes real property tax abatements for recycling assistance. Enter the number as shown on your State Business License or exemption issued by the Secretary of State. Businesses can fill out Form SS-4 online and get an EIN number quickly.

Failure to remit Nevada Use Tax Modified Business Tax Tire Fees Live Entertainment Tax Liquor or Tobacco Taxes. Nine states Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming have no income taxes. The Annual Franchise Tax Report must be filed every year in order to keep.

Video Training Now Available as of July 15 2016 As a part of the Departments effort to provide information to. Nevada South Dakota and Wyoming have no corporate or individual income tax though Nevada imposes gross receipts taxes. The Oregon legislature adopted a modified gross receipts tax imposed at 250 plus a rate.

Vehicle RV aircraft or vessel tax evasion. Here are the newest state business tax rankings. It has passed legislation to begin phasing out that tax starting in 2024 and ending in 2027.

Notice of Short Term Lessors Dealers and Brokers Legislative Changes. Alaska has no individual income or state-level sales tax. This 150 is due regardless of income or business activity.

A surtax is an additional tax levied on top of an already existing. Need quotation to verify It is also any activity or enterprise entered into for profitHaving a business name does not separate the business entity from the owner which means that the owner of the business is responsible and liable for debts. As per Section 26-54-104 of the Arkansas Corporate Franchise Tax Act all Arkansas LLCs are required to file an Annual Franchise Tax Report along with a flat-rate tax of 150.

Nevada Business ID Number. If not possible paper checks should be mailed to New Jersey Division of Taxation PO Box 666 Trenton NJ 08646-0666.

2014 2022 Form Mt Ui 5 Fill Online Printable Fillable Blank Pdffiller

Modified Business Tax Return Financial Institutions

Incorporate In Nevada Do Business The Right Way

Modified Business Tax Return Financial Institutions

Modified Business Tax Return Financial Institutions

Ask The Advisors Basic Tax Academy State Of Nevada Department Of Taxation Ppt Download